Activity in the Dutch maritime technology sector, which consists of over 100 shipyards and 800 maritime suppliers, rose slightly in 2018. Higher turnover does not always translate into a major growth in profit, however, and price levels remained under pressure in many companies.

Total turnover increased to € 7.3 billion, some € 400 million more than in 2017. Total employment was 29,072 FTEs, an increase of almost four per cent compared to the previous year. This was reported in the 2018 Annual Sector Report published by trade association Netherlands Maritime Technology (NMT).

Complex and Innvoative Vessels Remain Undisputed Spearhead

'2018 saw many new orders and many vessels completed in the Netherlands,' comments Bas Ort, chair of NMT. 'The focus right now is on complex and innovative vessels and we’re working with a huge diversity of designs. Our builders of seagoing vessels have had quite a hard time in 2018. It’s a testimony to their perseverance that they have never stopped innovating and attracting orders for new types of ships, despite the challenges. In this sense, they remain the undisputed spearhead for the sector.'

Too Many Yards for Too Few Ships

Around the world, the upward trend in the order intake for seagoing vessels continued into 2018. Yet, there is still not enough work to keep all the yards around the world in business. The consequences of this have been apparent in forced bankruptcies, mergers and increased government support, particularly in South Korea, China and Japan.

'We saw minor improvements in the Netherlands in 2018 compared to 2017, both for Dutch yards and suppliers,' Ort continues. 'A small step forward, but not one that came easy to the sector, which is being more creative than ever.'

Preserving Innovative Capacity and Strategic Knowledge

The maritime industry is a strategic sector with considerable social importance. 'Governments, both in The Hague and Brussels, must recognise the strategic role of our sector and act accordingly,' Ort stresses. 'The innovative capacity and strategic knowledge in the Netherlands need to be preserved, for instance by the Dutch business community playing a decisive role in the replacement programmes of the Royal Netherlands Navy.'

Role for Dutch Government

'NMT wants its members to be able to deliver sustainable, smart vessels and maritime technology in a global level playing field, with highly qualified workers working in safe and fair conditions,' Ort explains. 'The Dutch government has a role to play as a launching customer and provider of support for the export activities of the Dutch maritime technology sector. If these conditions are respected, the cautious progress the sector made in 2018 can become a major step forward in the coming years.'

Flexible Maritime Regulation

'Maritime regulations should help stimulate innovation, while remaining flexible enough to be rapidly adapted should developments require this. The shifting policies of different countries have led to persistent market disruptions in shipbuilding. A level playing field, both worldwide and within Europe, is one of the most important and complex issues.'

Figures of the Dutch Shipbuilding Cluster in 2018

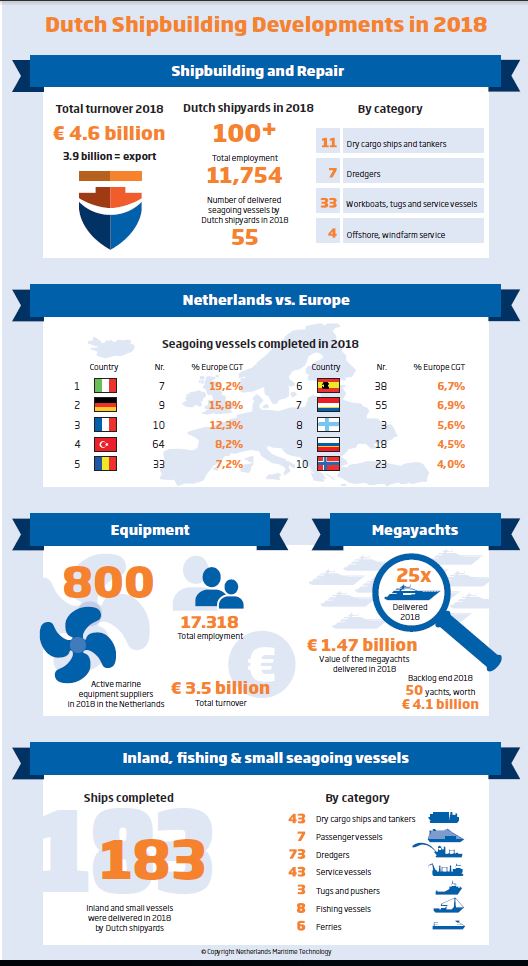

Infographic by NMT.

- Construction of seagoing vessels: The figures for 2018 show that the recovery of the order intake in the construction of seagoing vessels in the Netherlands has stalled. In 2018, the yards in this category received build contracts for 39 vessels (the corresponding figure in 2017 was 56). The drop in the number of orders is mainly due to a decrease in new orders for tugs and workboats. At € 643 million, the total value of the order intake is comparable to the years 2015 and 2016, but considerably lower than 2017 (€ 1,138 million). The atypical amount seen in 2017 was due to a few large complex orders being placed. The 58 vessels delivered in 2018, slightly fewer than the 55 seen in 2017, represented a value of € 589 million. The export share in terms of value of the vessels delivered was 58 per cent (57 per cent in 2017). Despite the decline in the order intake, the overall value of the order book remained stable at € 1.8 billion.

- Maritime suppliers: The trend towards sustainability and digitisation continued in 2018. Both these areas can strengthen the sector’s competitive position, as was already the case in 2018. The maritime turnover of the approximately 800 Dutch maritime suppliers was € 3.5 billion in 2018, a rise of 4.3 per cent compared to the previous year. Total employment in the sector was 17,318 FTEs (16,413 in 2017).

- Repair of seagoing vessels: The downward trend in the total turnover of Dutch repair sites was broken in 2018 for the first time in a number of years, although this cannot yet be described as a convincing recovery. While it is true that revenue was € 416 million in 2018 (€ 381 million in 2017), there is still much ground to reclaim as this figure was over € 562 million in 2015. Employment was 1751 FTEs (1710 in 2017).

- Inland navigation, fishing and small seagoing vessels: This category did exceptionally good business in 2018, with the dry docks and quaysides continuously busy. The order intake of luxury river cruise vessels in particular increased considerably over the previous year, and a great deal of maintenance work was carried out. In 2018, the yards in this segment received construction contracts for 185 new vessels (198 in 2017) and delivered 183 vessels (155 in 2017). While the number of new commissions fell slightly, the number of deliveries grew nicely. The order book remained stable with 143 vessels in the portfolio at the end of 2018 (146 in 2017).

- Superyacht construction: The size and value of superyachts continues to increase. Yacht builders are anticipating that this development will continue and are constructing new production facilities that can handle larger vessels. 25 superyachts were delivered in 2018 (the same as in 2017) with a value of € 1.5 billion (€ 1.2 billion in 2017), while 16 new orders were received (18 in 2017) with a value of almost € 1.1 billion (€ 1.2 billion in 2017). The collective order book contained 50 superyachts (57 in 2017) with a value of almost € 4.1 billion (€ 4.5 billion in 2017).

The above figures were presented on 16 May 2019 during the NMT association network meeting. The 2018 Annual Sector Report (English Summary on page 4 & 5) is available for download.

Picture: DP2 crane vessel Gulliver was built by Royal IHC and delivered to Scaldis in 2018 (picture by Flying Focus).