The Dutch seaports have become large thanks to the refineries and chemical industry. CO2 emissions are inextricably linked to this oil-based technology and CO2 production is therefore in the DNA of the Dutch seaports. The energy transition – the industry's necessary reduction in CO2 emissions – will therefore significantly change the port landscape and can only be achieved with drastic measures.

The vast majority of seaports in the Netherlands experienced an important period of growth in the 1960s and 1970s. At that time, (petro)chemical complexes were created in the ports of Rotterdam, Delfzijl, Terneuzen, Moerdijk, Amsterdam and Vlissingen. In 1976, the Dutch seaports had no less than seven petroleum refineries. Five of these were located in Rotterdam and Vlissingen had a Total refinery and Amsterdam a Mobil refinery [1]. At present, six refineries are still active in the Netherlands.

In addition to these refineries, there was an extensive chemical industry. This was related to the invention of new chemical products from the 1920s to 1940s by companies such as BASF, Bayer, Du Pont and Standard Oil and the completion of production facilities – with a delay of about twenty to thirty years after the invention of these products – in Western Europe and also in the Netherlands. This flow of investments in the petrochemical industry is often linked to a long wave in the economy, also known as the "second industrial revolution" or the Fourth Kondratieff wave – after the Russian economist Kondratieff. The Austrian economist Schumpeter also pointed out the link between waves of innovation and economic growth. To a large extent, this revolution took place in the Dutch seaports and was based on oil as a raw material for the chemical industry and as a fuel for the rapidly emerging automobile industry.

Stable Since the 1960s

Since the rise of oil and chemistry, not much has actually changed in our seaports. Compared to 1976, the Amsterdam refinery was closed down, the Chevron and later Nerefco refinery near Pernis was closed down and a small refinery was added in Rotterdam – now owned by raw material trader Vitol. The last, really large investment in the chemical industry in the Dutch seaports was the establishment of LyondellBasell on the Maasvlakte in Rotterdam in 2003. However, there have been a large number of small investments aimed at increasing the efficiency of production, cleaner production and the production of cleaner products, such as the recent investments by Shell and ExxonMobil in low-sulphur marine fuels in the port of Rotterdam. However, it is expected that within three decades, some of these refineries will no longer be in operation, which means that, currently, in terms of refinery capacity in the Netherlands there is a peak oil. In the last fifteen years, for example, refining capacity in Rotterdam increased by a further two per cent due to incremental capacity increases, but it is widely estimated that in the future there will be a possible closure of three of the six refineries in the Dutch seaports [2]. The main reason for this expected decrease is the energy transition.

In addition, investments are lagging behind, the scale of the installations is relatively small and the installations are outdated, especially compared to new factories in the Middle East, China and the US. The recent announcement that the British company Ineos will build two new large chemical plants worth three billion euros in Antwerp can therefore be regarded as a small miracle.

| Emissions from Dutch Ports | Mton | % of Total |

| North Sea Canal area (Noordzeekanaalgebied) | 19 | 12 |

| Rotterdam-Rijnmond area | 28 | 17 |

| North Sea Port (a) | 11 | 7 |

| Groningen Seaports | 11 | 7 |

| Moerdijk | 6 | 4 |

| Other (b) | 2 | 3 |

| Total | 77 | 47 (c) |

| Antwerp (d) | 18 | not applicable |

The Dutch seaports are responsible for almost half of the Dutch national CO2 emissions (165 Mton in 2017, source: Compendium voor de Leefomgeving, websites seaports). a) Including Ghent, b) estimation of the impact of the other seaports in our country based on NEA (2019), c) percentages do not total 47 per cent due to rounding, d) estimation based on various sources.

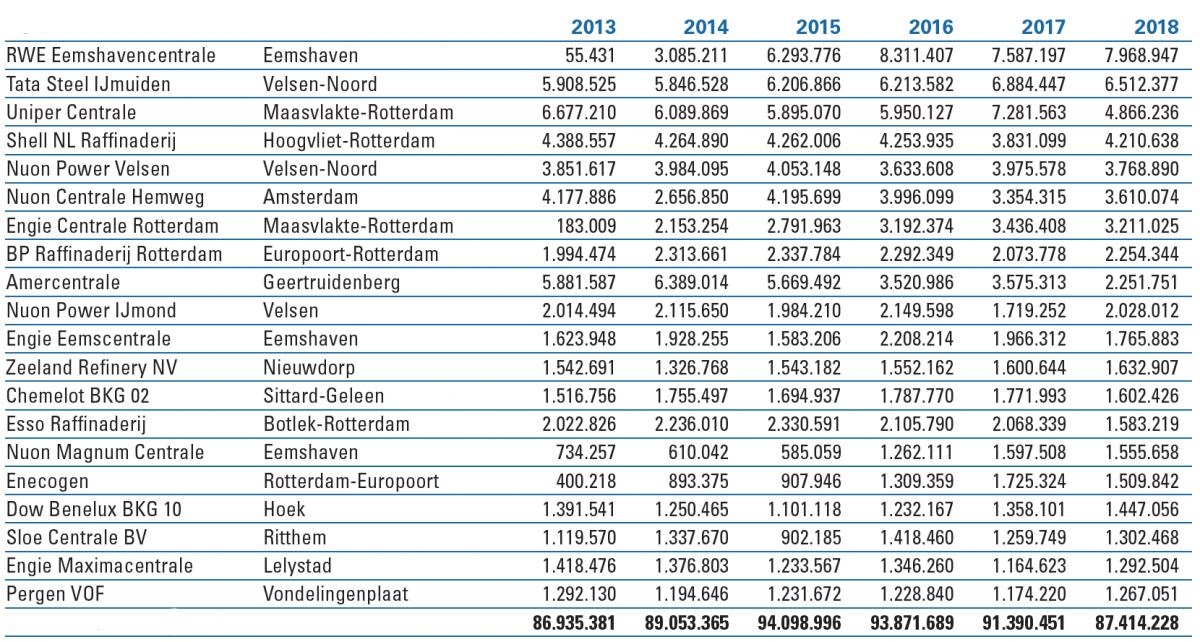

Primary sources of CO2 production in the Netherlands by company and location as well as total CO2 emissions by companies per year (source: NEA (2019), www.emissieautoriteit.nl/documenten/publicatie/2019/04/04/emissiecijfers-2013-2018).

Nearly Half of National CO2 Production

The fact that the production capacity of the petrochemical complexes in the seaports is still at the same level, means that there is still a dominance of the fossil industry in the Dutch ports. Together, the Dutch seaports even account for almost half of the country's total CO2 emissions (see table above). In particular, investments in three new, large coal-fired power plants have led to a sharp increase in emissions. For example, the development of RWE's Eemshaven power plant is the largest individual source of CO2 in the Netherlands (see table). Together with the two new coal-fired power plants on the Maasvlakte, this power station is emphatically the result of government policy from 2007. Without these new investments in CO2-producing coal-fired power plants, driven by the government, Tata Steel's location in the port of IJmuiden would be the most important source of CO2 in our country.

If we look at the individual sources of CO2 production, we see that of the twenty largest, only three are not located in a seaport area: the Amer power plant in Geertruidenberg, the Maxima power plant in Lelystad and the Chemelot site in Sittard-Geleen. However, all three of these complexes are linked to inland ports. Incidentally, if all sources of CO2 produced at the Chemelot site are combined, this location accounts for a total of 4.6 million tonnes: site number four. Dow Chemical in Terneuzen, with all its sources, also accounts for a total production of 4.2 million tonnes of CO2.

Can Seaports Become More Sustainable?

Because CO2 is produced in such large quantities in the Dutch seaports, many people wonder whether it is even possible to achieve the government's ambitious sustainability targets, in line with the Paris Agreement. According to the draft Dutch Climate Deal [3] that was published in December 2018, CO2 emissions must virtually stop by 2050 and fall by 49 per cent by 2030 compared to 1990. This means an indicative reduction target for industry of 14.3 Mton in 2030, in addition to existing policy (5.1 Mton), and a reduction of 20.2 Mton for the energy sector in 2030.

This means that, within ten years, a total of almost 40 Mton will have to be reduced by the Dutch industry and energy sector, most of which is located in the seaports. Of the total 77 Mton CO2 emitted by the Dutch seaports today, that means approximately forty per cent. Unfeasible? Certainly not. This requires dramatic interventions, but everything shows that these interventions can actually be realised in the coming years. The most important principles require a great deal of investment, but they do have a real effect.

Mix of Measures and Solutions

The proposed closure of the Hemweg power plant at the end of 2019 will already achieve a substantial part of the reduction target. In addition to closure, however, a large number of other measures are capable of reducing CO2 emissions to the goals of the Paris climate agreement. The Wuppertal Institute [4] convincingly illustrated this a few years ago for the port of Rotterdam. This involves a mix of measures and solutions, the most important of which are set out below.

First, use the best possible new technology in the port. Modern technology is often much more efficient and, therefore, more sustainable than older technology. The current progress in the technology of wind and solar energy and batteries is a good example of where development is much faster than anticipated: think of the latest generation of wind turbines with a capacity of fourteen megawatts, one of which is currently being built on the Maasvlakte with a "tip height" of between 245 to 260 metres. Therefore, investing in smaller wind turbines is sub-optimal. This means large-scale investment in the "best technology available" is an important starting point.

The second important solution is the capture, storage and possible reuse of CO2: carbon capture storage and use (CCS/U). The port of Rotterdam is currently developing a project for this purpose: the Porthos project – possibly together with North Sea Port and the Flemish ports. CCS maintains the production of CO2 and this technology also costs energy, meaning it is not the most sustainable solution, but indispensable as a temporary solution to achieve the ambitious objectives. In the future, CO2 could possibly be used as a raw material for industrial applications (usage), an example will be discussed below.

The third strategy is to focus on wind energy at sea on a very large scale, but also on other technology at sea, such as solar energy. It is known that this form of energy production involves the risk of windless periods combined with dense cloud cover, so that a shortage of electricity can arise and investments must therefore be made in storage and conversion – think of batteries, but also power-to-gas and green hydrogen. However, applications are also needed in which the production is directly matched to the supply of electricity, as Akzo Nobel does when investing in a new production line for chlorine and lye in the port of Rotterdam. Investing in large-scale offshore wind capacity also means that there will be great opportunities for employment in the maritime cluster in the Netherlands, making current coal-related employment seem tiny by comparison.

A fourth strategy is the use of biomass as a raw material – as a fuel, electrification is more sustainable – for further processing in the chemical and pharmaceutical industries. Biomass has disadvantages, such as competition with food production and highly damaging deforestation. The use of biomass must therefore be sustainable. This means the use of waste, such as used deep-frying fat or wood waste, or of algae or seaweed. Large-scale gasification of seaweed grown at sea in wind farms, a project by the Schiedam company Inrada, is an excellent example. At the moment there is a horseshoe-shaped spatial structure that runs from the Maasvlakte in the port of Rotterdam to the port of Ghent (see the figure), in which there is both extensive production of biomass and knowledge-intensive and high-quality applications around the biobased economy. In the period 2010-2016, 1.4 billion euros were invested in the biobased economy in the port of Rotterdam – a considerable amount, but only eleven per cent of the total industrial investments that mainly took place in fossil energy in this port. A final disadvantage is that producers of biodiesel also achieve significant CO2 emissions, approximately 1 Mton in Rotterdam in 2017, although this will decrease because the Finnish company Neste switched to wind as a source of energy in 2018.

The biobased-industry in the Rhine–Meuse–Scheldt delta [8].

A fifth important strategy is to focus on the circular economy. This involves two points of leverage. The first concerns the cycles of raw materials, residual materials, waste streams and heat or cold. These are industrial applications in which by-products or residual products from one manufacturer form the input for another, the so-called industrial ecology or symbiosis. An example is the project in which ArcelorMittal, a steel company based in Ghent, collaborates with Dow in Terneuzen to capture and store CO2 (CCS) and to reuse it as a raw material for the chemical industry. Dow uses the carbon dioxide to produce hydrocarbons; ArcelorMittal uses this for the production of bioethanol [5]. Waste streams can also be used as raw materials (waste-to-chemicals). Therefore, it is possible for the cluster in a seaport to grow because companies may relocate in order to benefit from circular advantages. In doing so, the cluster will become denser.

However, the circular economy is mainly focused on preventing waste through maintenance, re-use and extending product life – the second important aspect of this concept. This means that materials are reused in new products, that these products are designed for this re-use and that fewer raw materials are needed. This of course will impact the production of the basic materials for these raw materials in the seaports.

A sixth, much-discussed strategy relates to financial incentives, both negative and positive. An example of the first category is emissions trading and a possible CO2 tax. This CO2 tax in particular, is currently the subject of a great deal of debate with possible consequences for an uneven playing field with regard to the seaports that are not exposed to such a tax. In addition to levies, stimulating sustainable investments by means of subsidies is an important positive incentive.

Finally, action can be taken with regard to the use of fuels: the banning of cars that use petrol or diesel, as proposed by the municipality of Amsterdam for 2030, or the completely emission-free new sale of passenger cars in 2030, as proposed in the draft Climate Agreement. A large number of variants of this type of intervention are possible, with eventual consequences for the production of the industry located in the seaports, in particular for the refining of petroleum. However, the decisive factor is the consumer: the behaviour of millenials and "Generation Z", which is now protesting on the streets for a strict climate policy, is decisive. Will they massively switch to electrically-powered shared cars – if they want to obtain a driving licence at all? Will eating meat soon be the new smoking? Will slow fashion really become the norm? Ultimately, these choices are also reflected in the performance of our seaports.

The former Engie power plant on the Maasvlakte in Rotterdam is hidden behind mountains of coal.

In addition to the above-mentioned steps that can reduce CO2 production in seaports, there is also a large number of additional possibilities, including reducing CO2 emissions by ships and road traffic to and from the ports. These include shore-side electricity, (bio)LNG and slow steaming. Another option is to invest heavily in innovations aimed at increasing sustainability.

Achievable Targets

In the period 2010-2015, the industry based in the Dutch seaports invested 22 billion euros in mainly fossil industrial projects. Earlier in this article, it was calculated for Rotterdam that only eleven per cent was spent on bio-based production capacity. In addition, the other sectors – especially logistics – invested a further 14 billion euros in the Dutch seaports. Public investment was clearly lagging behind, at three billion euros during this period. In total, public and private investments in the Dutch seaports amounted to 39 billion euros over the six-year period: 6.5 billion euros per year.

A similar impulse is needed in sustainable investments, starting with investments in offshore wind. In the period 2013-2016, 25 billion euros was invested in offshore wind – but worldwide. These investments are growing rapidly, but are far less than the 107 billion euros that were spent on onshore and offshore wind energy in 2017 alone according to IRENA (the International Renewable Energy Agency). European offshore wind capacity grew by 25 per cent in 2017, with more large Dutch wind farms to come.

In the eighteen years between 1953 and 1970, Dutch industry's investments grew by an average of more than eight per cent a year, after which they came to a standstill in the 1970s and early 1980s. The very extensive petroleum-based port and industrial complexes in our country were built in just over a decade and a half. This should make it possible to restructure this complex in the coming three decades and make it climate-neutral. This is to be made possible by the rapid decline in the cost of sustainable technology, emphasising the important role played by innovation and by structurally adhering to the clear political objectives set out in the Paris Agreement. This means the objectives set out in the draft Dutch Climate Deal are achievable.

The Dutch ports will be equipped with hydrogen plants, CO2 networks, bioethanol, bio-naphtha, bio-LNG and waste-to-chemical plants and large complexes aimed at construction of and maintenance for offshore wind sooner than anticipated. Well before 2030, the first new, sustainable investments will be made in the current coal terminals and the endless tank parks in the ports.

This article was originally published (in Dutch) as part of SWZ|Maritime’s June Port Special. Author of the article is Bart Kuipers, Port Economist at the Erasmus Centre for Urban, Port and Transport Economics (UPT).

Picture top: Characteristic landscape in the Dutch seaports: part of the Shell complex in Pernis.

References

- R. Tamsma et al. (1976), “Zeehavens”, in: Atlas van Nederland, Den Haag: Staatsdrukkerij- en Uitgeverijbedrijf, blad XVI-8

- H. van Santen (2019), “Voor raffinaderijen is de Botlek niet langer vanzelfsprekend”, in: NRC Handelsblad, 20-21 april 2019, blz. E8-E10

- www.klimaatakkoord.nl/klimaatakkoord/documenten/publicaties/2018/12/21/ontwerp-klimaatakkoord

- Wuppertal Institut (2016), “Report: Decarbonisation Pathways for the Industrial Cluster of the Port of Rotterdam”, Wuppertal: Wuppertal Institut

- www.maritiemnederland.com/nieuws/arcelormittal-endow-werken-aan-opslag-en-hergebruik-co2-in-haven/item3259

- L. van der Lugt et al. (2017), “Havenmonitor – De economische betekenis van Nederlandse zeehavens 2002-2016”, Rotterdam: Erasmus UPT

- www.duurzaambedrijfsleven.nl/energie/27137/trendrapport-2017-was-een-recordjaar-voor-offshore-wind

- R.E. Waterman en B. Kuipers (2019), “Aquapunctuur geeft structuur aan de toekomst van de Rijn-Maas-Schelde Delta” (to be published shortly)