Diminishing attractiveness of a career at sea, coupled with rising man-berth ratios and continued fleet growth will lead to the highest shortfall of officers to crew the world’s merchant fleet in over a decade by 2026. This follows from the latest Manning Annual Review and Forecast report published by global shipping consultancy Drewry.

The shortage also has important implications for both hiring and future manning cost inflation, states Drewry.

The current officer supply shortfall is estimated to equate to around three per cent of the global pool, which is broadly manageable and is not noticeably impacting hiring, but is to some extent masked by the temporary idling of vessels in certain sectors such as cruise, due to the Covid-19 pandemic. Ratings supply is much more elastic due to lower entry requirements and short training periods.

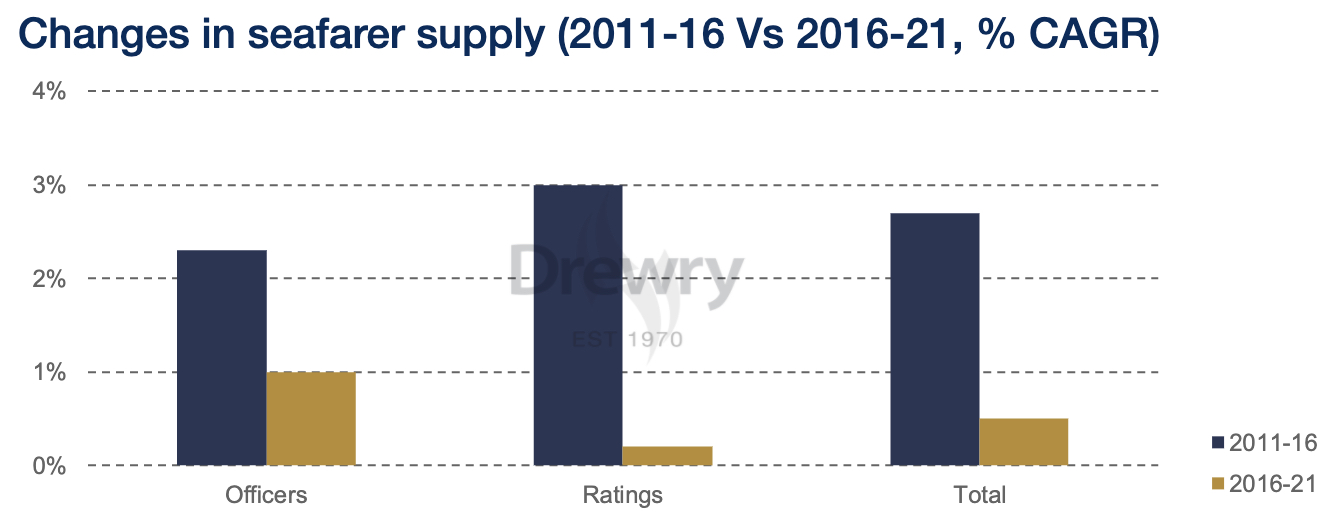

However, looking ahead to 2026 the supply/demand gap is expected to widen to a deficit equating to over five per cent of the global officer pool and the highest level since 2013. The principal reason for this is the slowdown in officer supply as the attractiveness of a career at sea is diminishing. In the five years to 2016, the supply of seafarers available to crew the global merchant fleet was growing at an average annual rate of 2.7 per cent, according to Drewry estimates. However, over the last five years this growth rate has shrunk to just 0.5 per cent annually (see chart).

Source: Drewry‘s Manning Annual Review and Forecast 2021/22.

‘With the ongoing negative effects of life at sea brought about by the Covid-19 pandemic, some seafarers may bring retirement plans forward, while others may look for work ashore,’ says Drewry’s head of manning research Rhett Harris. ‘It has been the case for a number of years that quality officers have been difficult to recruit and retain. This situation is expected to get worse as the growth in supply fails to keep pace with an expanding world fleet.’

Manning costs to rise

Despite these trends, underlying aggregate manning costs, excluding the impact of Covid-19, are expected to rise moderately in 2021, according to Drewry estimates, increasing just 0.4 per cent over the year, a similar pace to last year. Looking further ahead, tightening labour market conditions and better affordability will drive up crewing costs, but increases will remain below the prevailing rate of consumer price inflation.

Also read: Covid-19 drives up ship operating costs

‘While ratings supply has slowed, availability is relatively elastic and wage levels will remain driven by collective bargaining arrangements,’ explains Harris. ‘By contrast, officer remuneration is more market driven, but the widening shortage of officers is expected to affect the quality more than the quantity available for service. Drewry therefore expects employers currently paying low-wages will be more affected by fallout from the Covid-19 pandemic, as disgruntled seafarers are enticed to better paying owners or different roles ashore.’